Bluerock Residential Growth REIT Announces Third Quarter 2019 Results

Total Revenues Grew 11.8% to $53.5 Million

Same Store Revenue Grew 4.3% YoY

New York, NY (November 5, 2019) – Bluerock Residential Growth REIT, Inc. (NYSE American: BRG) (“the Company”), an owner of highly amenitized multi-family apartment communities, announced today its financial results for the quarter ended September 30, 2019.

Highlights

- Total revenues grew 11.8% to $53.5 million for the quarter from $47.9 million in the prior year period.

- Net income attributable to common stockholders for the third quarter of 2019 was $0.75 per diluted share, as compared to net loss attributable to common stockholders of ($0.44) per diluted share in the prior year period.

- Property Net Operating Income (“NOI”) grew 15.9% to $28.0 million from $24.2 million in the prior year period.

- Same store revenue and same store NOI increased 4.3% and 4.3% respectively, as compared to the prior year period.

- Core funds from operations attributable to common stockholders and unit holders (“CFFO”) was $5.8 million, compared to $6.4 million in the prior year period. CFFO per diluted share is $0.19 for the quarter as compared to $0.21 in third quarter 2018. The change year over year was due in part to the timing of reinvestment of capital from asset dispositions in the quarter as part of the Company’s recycling into higher growth assets. The Company is reaffirming its 2019 CFFO per share guidance range.

- Completed the sale of seven assets during the quarter, totaling approximately $369 million at an economic cap rate of 4.7%.

- Invested in two multifamily communities totaling 965 units for a total purchase price of $193.1 million. The two new acquisitions are projected to yield a year one economic cap rate of 4.9% and grow to north of 6.0%. The Company maintains a robust pipeline and is actively working on closing additional investments by year end.

- Invested $9.9 million in new preferred investments in two unrelated third-party operating multifamily communities totaling 304 units in Austin, Texas.

- Paid quarterly common stock dividend of $0.1625, an 86% payout on a CFFO basis.

- Consolidated real estate investments, at cost, increased approximately $22.1 million to $1.8 billion, from year end.

- Completed 263 value-add unit upgrades during the quarter producing a 22.7% ROI through increased monthly rental rates.

“We produced strong operating results in the third quarter in-line with our expectations, with property NOI up 15.9% and same store NOI that increased 4.3%,” said Ramin Kamfar, Company Chairman and CEO. “These results reflect the successful execution of our strategy which includes creating value through our unit upgrade program and operational improvements. During the quarter, we completed multiple asset sales and recycled the proceeds into attractive assets with a stronger long-term growth profile and immediate value-add renovation opportunities. As we look ahead, we remain optimistic as we continue to realize the embedded growth opportunities within our portfolio, along with identifying attractive investments to expand our portfolio of highly amenitized communities in targeted growth markets.”

Financial Results

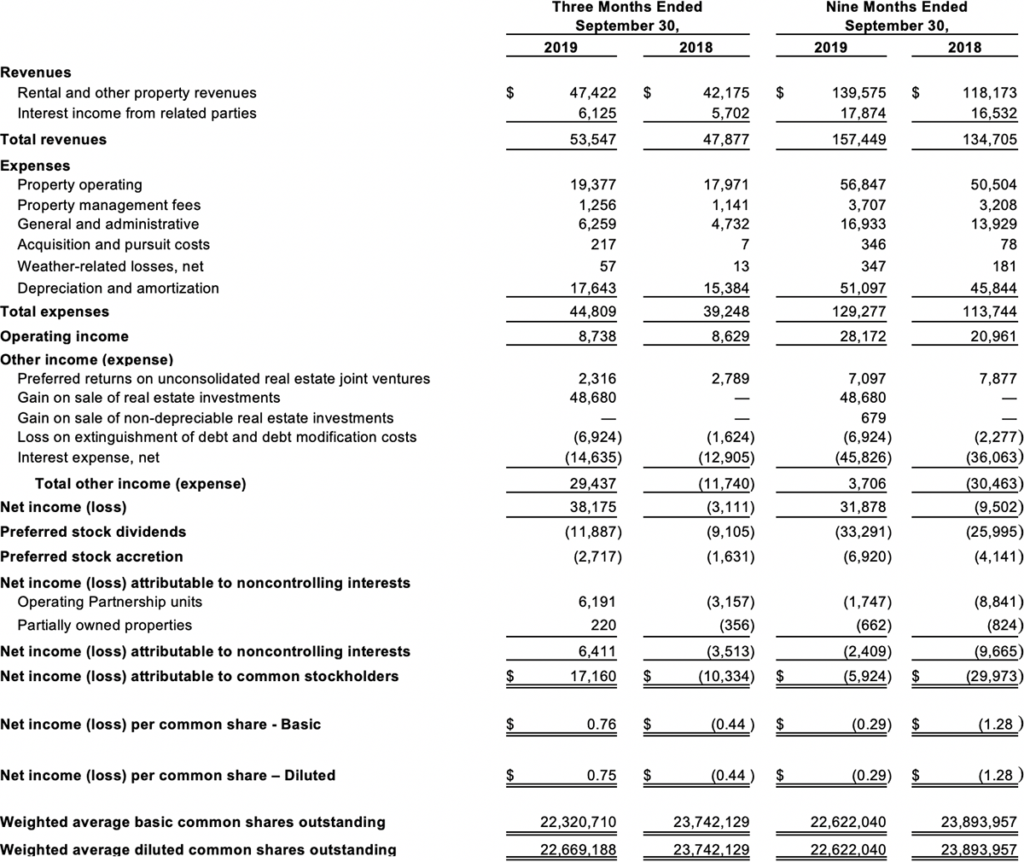

Net income attributable to common stockholders for the third quarter of 2019 was $17.2 million, or $0.75 per diluted share, compared to a net loss attributable to common stockholders of ($10.3) million, or ($0.44) per diluted share, in the prior year period. Net income attributable to common stockholders included non-cash expenses of $17.5 million, or $0.77 per share in the third quarter of 2019 compared to non-cash expense of $14.2 million or $0.60 per share for the prior year period. Net income attributable to common stockholders for the third quarter of 2019 was positively impacted by the gain on sale of real estate investments of $1.56 per diluted share.

CFFO for the third quarter of 2019 was $5.8 million, or $0.19 per diluted share, compared to $6.4 million, or $0.21 per diluted share, in the prior year period. CFFO was primarily driven by growth in property NOI of $3.8 million and interest income of $0.4 million arising from investment activity. This was primarily offset by a year-over-year rise in interest expense of $1.5 million and preferred stock dividends of $2.8 million. Timing of acquisitions and dispositions, together with the requirement to place the sale proceeds in escrow to effectuate 1031 exchanges which limited the Company’s ability to paydown its credit facilities, accounted for the majority of the year-over-year per share decrease.

Total Portfolio Performance

(1) Including interest income from related parties

For the third quarter of 2019, property revenues increased by 11.8% compared to the same prior year period primarily attributable to the increased size of the portfolio. Total portfolio NOI was $28.0 million, an increase of $3.8 million, or 15.9%, compared to the same period in the prior year.

Property NOI margins were 59.1% of revenue for the quarter, an increase of 170 basis points compared to 57.4% of revenue in the prior year quarter. Property operating expenses were up primarily due to the increased size of the portfolio.

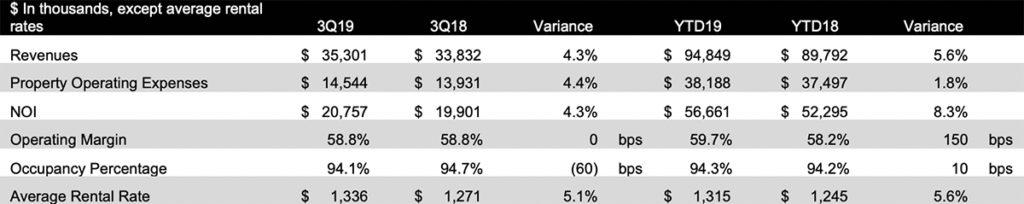

Same Store Portfolio Performance

The Company’s same store portfolio for the quarter ended September 30, 2019 included 25 properties. For the third quarter of 2019, same store NOI was $20.8 million, an increase of $0.9 million, or 4.3%, compared to the prior year period. Same store property revenues increased by 4.3% compared to the same prior year period, primarily attributable to a 5.1% increase in average rental rates partially offset by average occupancy decreasing 60 basis points to 94.1%. Same store expenses increased $0.6 million primarily due to higher real estate taxes and insurance premiums, and increases in turnover, repairs and maintenance, and payroll costs.

Renovation Activity

The Company completed 263 value-add unit upgrades during the third quarter producing a 22.7% ROI through increased monthly rental rates.

Since inception within the existing portfolio, the Company has completed 2,434 value-add unit upgrades at an average cost of $5,123 per unit and achieved an average monthly rental rate increase of $108 per unit, equating to a 25.2% ROI on all unit upgrades leased as of September 30, 2019. The Company has identified approximately 4,307 remaining units within the existing portfolio for value-add upgrades with similar projected economics to the completed renovations. The Company has completed 768 unit renovations year to date and continues to expect to complete between 900 and 1,200 in 2019.

Portfolio Activity

During the third quarter, the Company completed investments totaling $203 million. These investments include the following:

- On July 24, 2019, acquired a 100% interest in a 645-unit apartment community located in Scottsdale, Arizona, known as Denim. The total purchase price was approximately $141.3 million, funded in part by a $91.6 million mortgage loan secured by the Denim property.

- On July 31, 2019, acquired a 100% interest in a 320-unit apartment community located in Las Vegas, Nevada, known as The Sanctuary. The total purchase price was approximately $51.8 million, funded in part by a $33.7 million mortgage loan secured by the Sanctuary property.

- On September 17 and September 25, 2019, made preferred equity investments totaling $9.9 million into two Austin, Texas operating assets with 304-units called Mira Vista and Thornton Flats.

During the third quarter, the Company completed the following dispositions:

- On July 15, and August 29, 2019, closed on the portfolio sale of its investments in Sorrel, Sovereign, Preston View, Leigh House, and ARIUM Palms for approximately $273.7 million.

- On September 20, 2019, closed on the portfolio sale of its investments in Marquis at Crown Ridge and Marquis at Stone Oak for approximately $95.0 million.

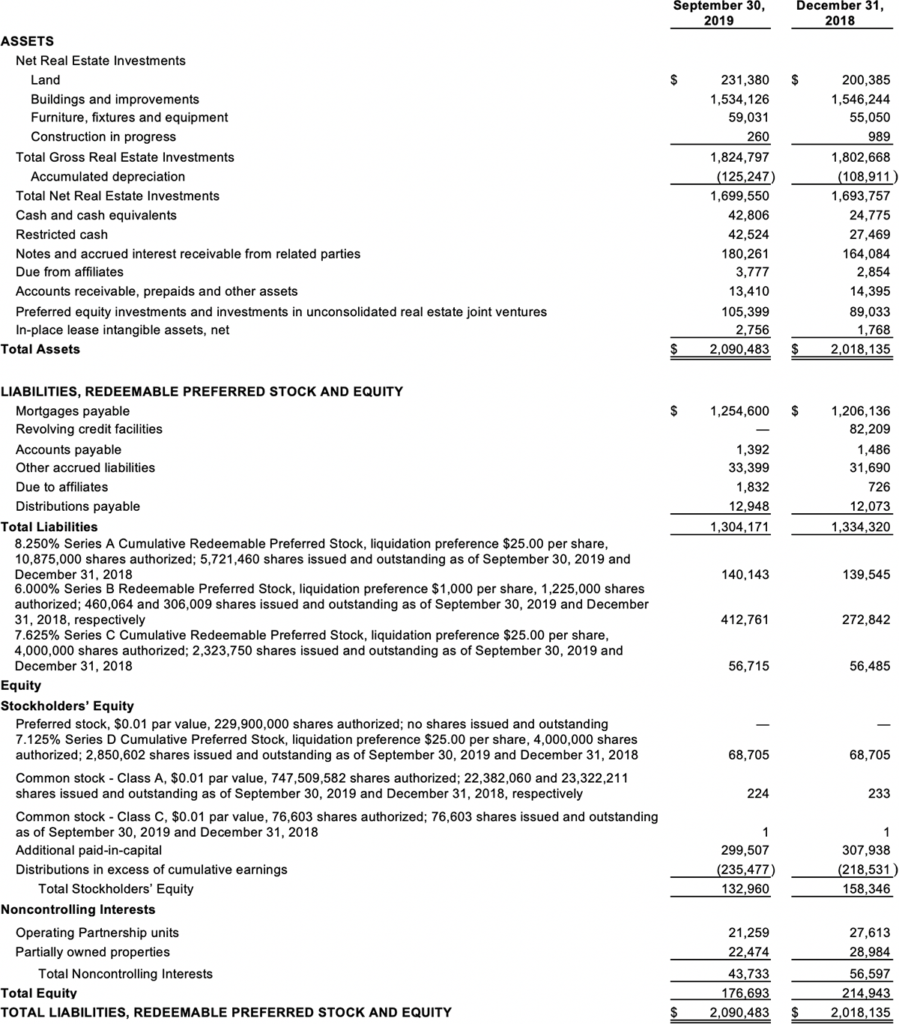

Balance Sheet

During the third quarter, the Company raised gross proceeds of approximately $61.5 million through the issuance of 61,491 shares of Series B preferred stock with associated warrants at $1,000 per unit.

As of September 30, 2019, the Company had $42.8 million of unrestricted cash on its balance sheet, approximately $78.5 million available among its revolving credit facilities, and $1.3 billion of debt outstanding.

Dividend Details

The Board of Directors authorized, and the Company declared, a quarterly dividend for the third quarter of 2019 equal to a quarterly rate of $0.1625 per share on its Class A common stock, payable to the stockholders of record as of September 25, 2019, which was paid in cash on October 4, 2019. A portion of each dividend may constitute a return of capital for tax purposes. There is no assurance that the Company will continue to declare dividends or at this rate.

The Board of Directors authorized, and the Company declared a quarterly cash dividend on its 8.250% Series A Cumulative Redeemable Preferred Stock for the third quarter of 2019, in the amount of $0.515625 per share. In addition, the Company declared a quarterly cash dividend on its 7.625% Series C Cumulative Redeemable Preferred Stock for the third quarter of 2019, in the amount of $0.4765625 per share. Further, the Company declared a quarterly cash dividend on its 7.125% Series D Cumulative Preferred Stock for the third quarter of 2019, in the amount of $0.4453125 per share. The dividends were payable to the stockholders of record on September 25, 2019 and were paid on October 4, 2019.

On October 14, 2019, the Board of Directors authorized, and the Company declared, a monthly dividend of $5.00 per share of Series B preferred stock, payable to the stockholders of record as of October 25, 2019, which was paid in cash on November 5, 2019. On October 31, 2019, the Board of Directors authorized, and the Company declared, a monthly dividend of $5.00 per share, each prorated on the basis of the actual number of days in the applicable dividend period during which each such share was outstanding. Such prorated dividends will be payable in cash on each of (i) December 5, 2019 (to holders of record on November 25, 2019), and (ii) January 3, 2020 (to holders of record on December 24, 2019).

2019 Guidance

The Company is reaffirming its prior guidance. Based on the Company’s current outlook and market conditions, the Company anticipates 2019 CFFO in the range of $0.81 to $0.84 per share. For additional guidance details, please see page 31 of Company’s Third Quarter 2019 Earnings Supplement available under Investors on the Company’s website (www.bluerockresidential.com).

Conference Call

All interested parties can listen to the live conference call at 11:00 AM ET on Tuesday, November 5, 2019 by dialing +1 (866) 843-0890 within the U.S., or +1 (412) 317-6597, and requesting the “Bluerock Residential Conference.”

For those who are not available to listen to the live call, the conference call will be available for replay on the Company’s website two hours after the call concludes, and will remain available until December 5, 2019 at http://services.choruscall.com/links/brg191105.html, as well as by dialing +1 (877) 344-7529 in the U.S., or +1 (412) 317-0088 internationally, and requesting conference number 10135863.

The full text of this Earnings Release and additional Supplemental Information is available in the Investors section on the Company’s website at bluerockresidential.com.

About Bluerock Residential Growth REIT, Inc.

Bluerock Residential Growth REIT, Inc. (NYSE American: BRG) is a real estate investment trust that focuses on developing and acquiring a diversified portfolio of institutional-quality highly amenitized live/work/play apartment communities in demographically attractive knowledge economy growth markets to appeal to the renter by choice. The Company’s objective is to generate value through off-market/relationship-based transactions and, at the asset level, through value add improvements to properties and operations. The Company is included in the Russell 2000 and Russell 3000 Indexes. BRG has elected to be taxed as a real estate investment trust (REIT) for U.S. federal income tax purposes.

For more information, please visit the Company’s website at bluerockresidential.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are based upon the Company’s present expectations, but these statements are not guaranteed to occur. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. Investors should not place undue reliance upon forward-looking statements. For further discussion of the factors that could affect outcomes, please refer to the risk factors set forth in Item 1A of the Company’s Annual Report on Form 10-K filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) on February 27, 2019, and subsequent filings by the Company with the SEC. We claim the safe harbor protection for forward looking statements contained in the Private Securities Litigation Reform Act of 1995.

Portfolio Summary

The following is a summary of our operating real estate and mezzanine/preferred investments as of September 30, 2019:

(1) Represents date of last significant renovation or year built if there were no renovations.

(2) Represents the average effective monthly rent per occupied unit for the three months ended September 30, 2019.

(3) Percent occupied is calculated as (i) the number of units occupied as of September 30, 2019, divided by (ii) total number of units, expressed as a percentage.

(4) The average effective monthly rent including sold properties was $1,313 for the three months ended September 30, 2019.

(5) The average effective monthly rent including sold properties was $1,693 for the three months ended September 30, 2019.

(6) The average effective monthly rent including sold properties was $1,397 for the three months ended September 30, 2019.

* The development is in the planning phase, project specifications are in process.

Consolidated Statement of Operations

For the Three and Nine Months Ended September 30, 2019 and 2018

(Unaudited and dollars in thousands except for share and per share data)

Consolidated Balance Sheets

Third Quarter 2019

(Unaudited and dollars in thousands except for share and per share amounts)

Non-GAAP Financial Measures

The foregoing supplemental financial data includes certain non-GAAP financial measures that we believe are helpful in understanding our business and performance, as further described below. Our definition and calculation of these non-GAAP financial measures may differ from those of other REITs, and may, therefore, not be comparable.

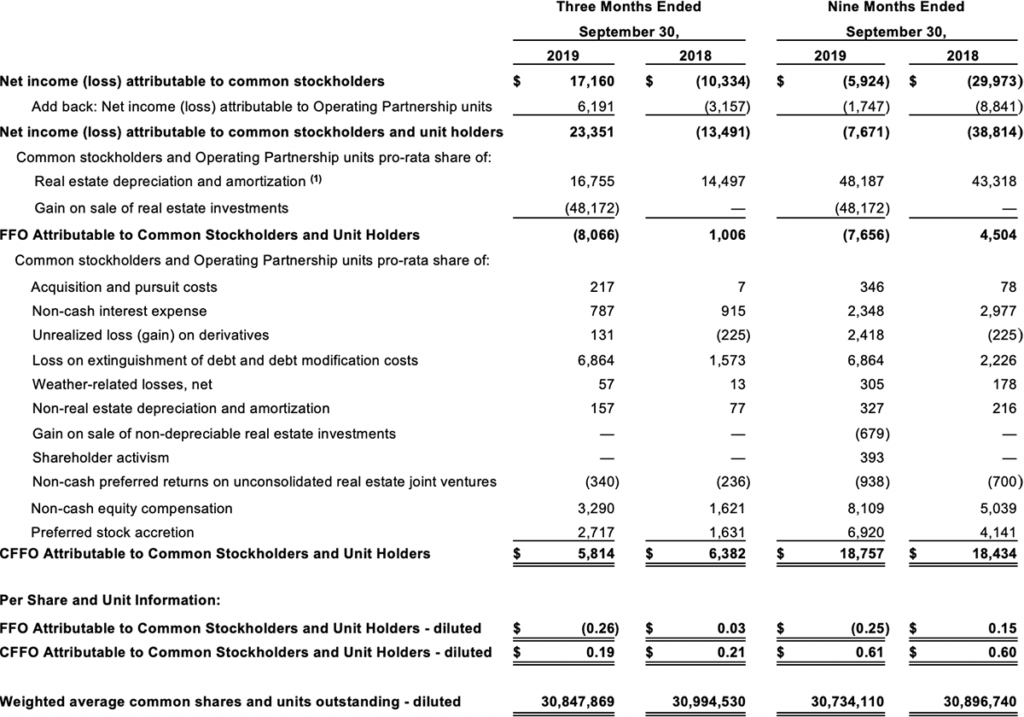

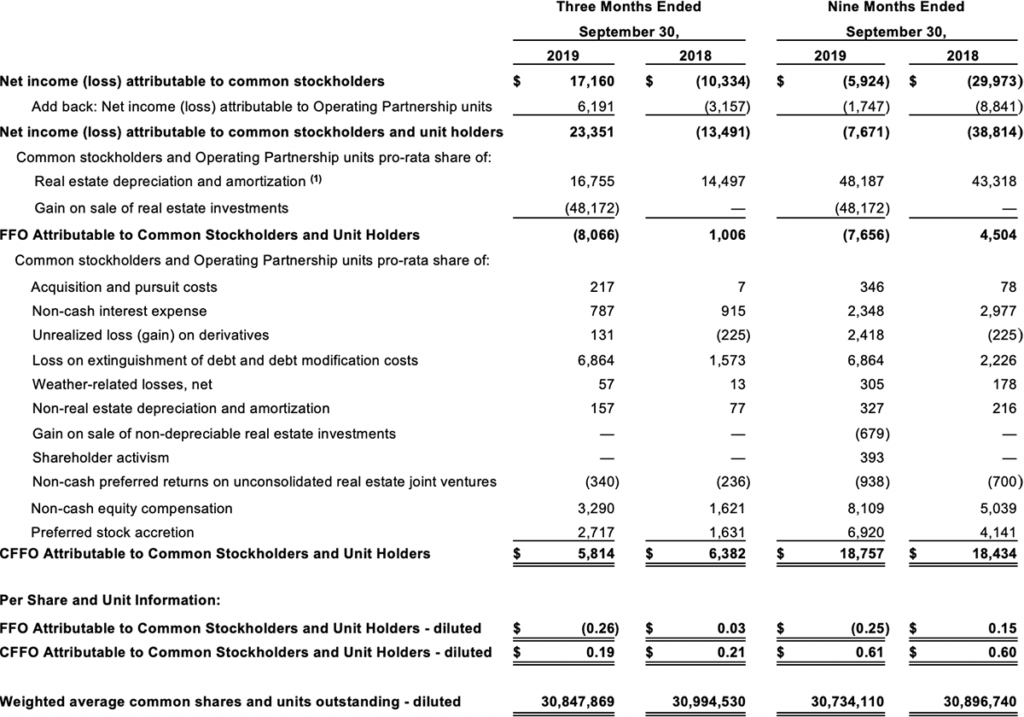

Funds from Operations and Core Funds from Operations Attributable to Common Stockholders and Unit Holders

We believe that funds from operations (“FFO”), as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), and core funds from operations (“CFFO) are important non-GAAP supplemental measures of operating performance for a REIT.

FFO attributable to common stockholders and unit holders is a non-GAAP financial measure that is widely recognized as a measure of REIT operating performance. We consider FFO to be an appropriate supplemental measure of our operating performance as it is based on a net income analysis of property portfolio performance that excludes non-cash items such as depreciation. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values historically rise and fall with market conditions, presentations of operating results for a REIT, using historical accounting for depreciation, could be less informative. We define FFO, consistent with the NAREIT definition, as net income, computed in accordance with GAAP, excluding gains or losses on sales of depreciable real estate property, plus depreciation and amortization of real estate assets, plus impairment write-downs of depreciable real estate, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis.

CFFO makes certain adjustments to FFO, removing the effect of items that do not reflect ongoing property operations such as acquisition expenses, non-cash interest, unrealized gains or losses on derivatives, losses on extinguishment of debt and debt modification costs (includes prepayment penalties incurred and the write-off of unamortized deferred financing costs and fair market value adjustments of assumed debt), one-time weather-related costs, gains or losses on sales of non-depreciable real estate property, shareholder activism, stock compensation expense and preferred stock accretion. We believe that CFFO is helpful to investors as a supplemental performance measure because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our core recurring property operations. As a result, we believe that CFFO can help facilitate comparisons of operating performance between periods and provides a more meaningful predictor of future earnings potential.

Our calculation of CFFO differs from the methodology used for calculating CFFO by certain other REITs and, accordingly, our CFFO may not be comparable to CFFO reported by other REITs. Our management utilizes FFO and CFFO as measures of our operating performance after adjustment for certain non-cash items, such as depreciation and amortization expenses, and acquisition and pursuit costs that are required by GAAP to be expensed but may not necessarily be indicative of current operating performance and that may not accurately compare our operating performance between periods. Furthermore, although FFO and CFFO and other supplemental performance measures are defined in various ways throughout the REIT industry, we also believe that FFO and CFFO may provide us and our stockholders with an additional useful measure to compare our financial performance to certain other REITs.

Neither FFO nor CFFO is equivalent to net income, including net income attributable to common stockholders, or cash generated from operating activities determined in accordance with GAAP. Furthermore, FFO and CFFO do not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments or uncertainties. Neither FFO nor CFFO should be considered as an alternative to net income, including net income attributable to common stockholders, as an indicator of our operating performance or as an alternative to cash flow from operating activities as a measure of our liquidity.

We have acquired five operating properties and made six property investments through preferred equity interests or mezzanine loans, and sold seven operating properties subsequent to September 30, 2018. Therefore, the results presented in the table below are not directly comparable and should not be considered an indication of our future operating performance.

The table below reconciles our calculations of FFO and CFFO to net income (loss) attributable to common stockholders, the most directly comparable GAAP financial measure, for the three and nine months ended September 30, 2019 and 2018 (in thousands, except per share amounts):

(1) The real estate depreciation and amortization amount includes our share of consolidated real estate-related depreciation and amortization of intangibles, less amounts attributable to noncontrolling interests – partially owned properties, and our similar estimated share of unconsolidated depreciation and amortization, which is included in earnings of our unconsolidated real estate joint venture investments.

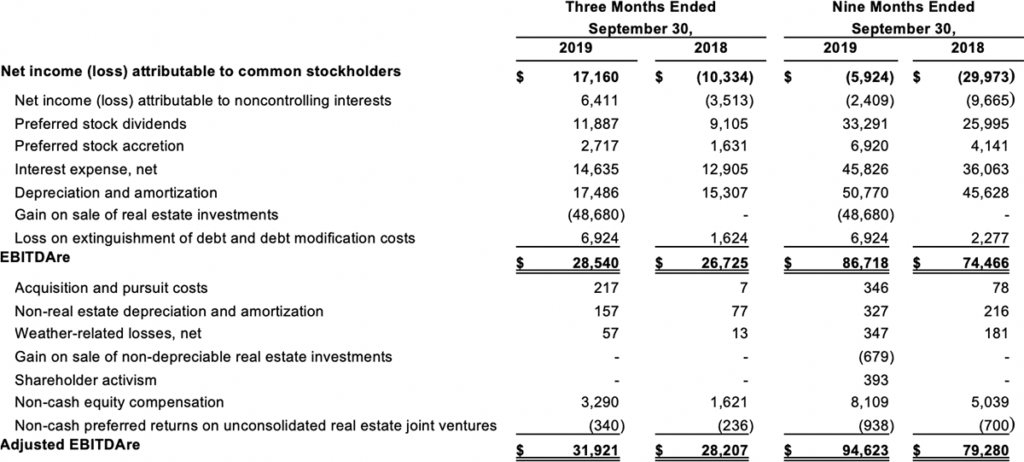

Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”)

NAREIT defines earnings before interest, taxes, depreciation and amortization for real estate (“EBITDAre”) (September 2017 White Paper) as net income, computed in accordance with GAAP, before interest expense, income taxes, depreciation and amortization expense, and further adjusted for gains and losses from sales of depreciated operating properties, and impairment write-downs of depreciated operating properties.

We consider EBITDAre to be an appropriate supplemental measure of our performance because it eliminates depreciation, income taxes, interest and non-recurring items, which permits investors to view income from operations unobscured by non-cash items such as depreciation, amortization, the cost of debt or non-recurring items.

Adjusted EBITDAre represents EBITDAre further adjusted for non-comparable items and it is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not consider certain cash requirements such as income tax payments, debt service requirements, capital expenditures and other fixed charges.

EBITDAre and Adjusted EBITDAre are not recognized measurements under GAAP. Because not all companies use identical calculations, our presentation of EBITDAre and Adjusted EBITDAre may not be comparable to similarly titled measures of other companies.

Below is a reconciliation of net income (loss) attributable to common stockholders to EBITDAre (unaudited and dollars in thousands).

Same Store Properties

Same store properties are conventional multifamily residential apartments which were owned and operational for the entire periods presented, including each comparative period.

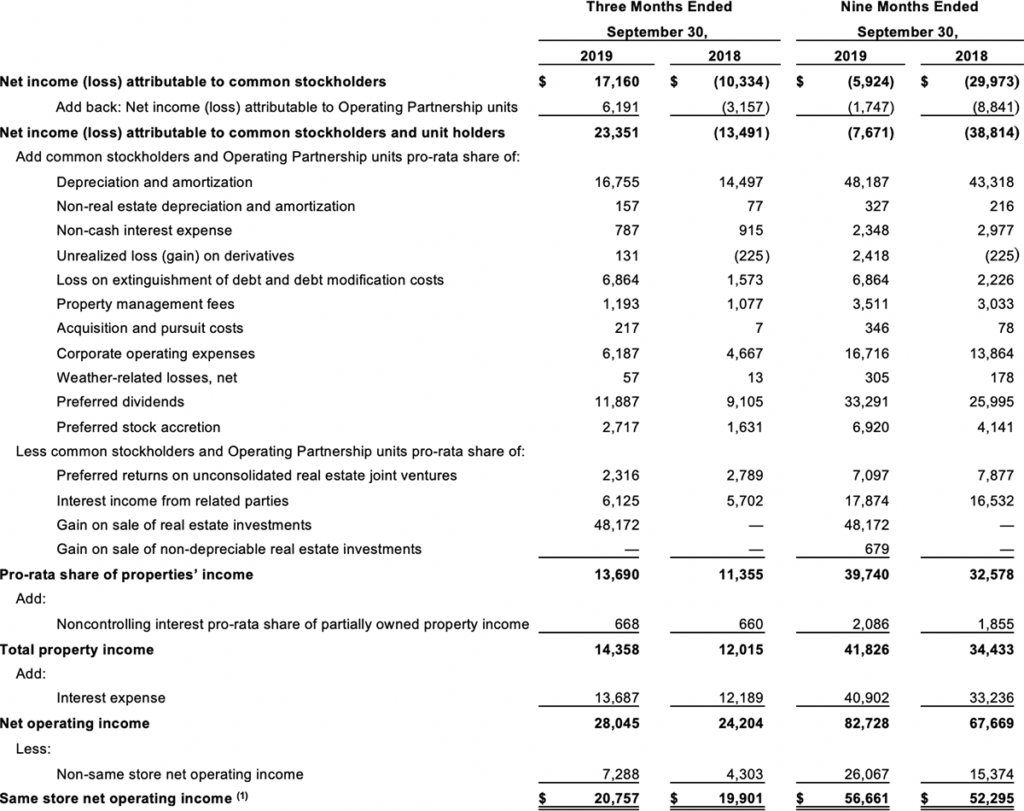

Property Net Operating Income (“Property NOI”)

We believe that net operating income, or NOI, is a useful measure of our operating performance. We define NOI as total rental and other property revenues less total property operating expenses, excluding depreciation and amortization and interest. Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REITs. We believe that this measure provides an operating perspective not immediately apparent from GAAP operating income or net income. We use NOI to evaluate our performance on a same store and non-same store basis; NOI measures the core operations of property performance by excluding corporate level expenses and other items not related to property operating performance and captures trends in rental housing and property operating expenses. However, NOI should only be used as a supplemental measure of our financial performance.

The following table reflects net income (loss) attributable to common stockholders together with a reconciliation to NOI and to same store and non-same store contributions to consolidated NOI, as computed in accordance with GAAP for the periods presented (unaudited and amounts in thousands):

(1) Same store portfolio for the three months ended September 30, 2019 consists of 25 properties, which represent 8,379 units. Same store portfolio for the nine months ended September 30, 2019 consists of 22 properties, which represent 7,613 units.